AlphaWealth Trading Strategy: Generating Cash Flow in Small Timeframes

- Writer

- Mar 6

- 4 min read

AlphaWealth is a trading system that employs a reversal strategy, executing trades when the chart shows reversal signals. This innovative approach focuses on trading the AUD/CAD currency pair within the M15 timeframe.

By opting for small timeframes, this system maintains a moderate number of orders—striking a balance to enhance profitability. Based on our EA configuration recommendations, we advise using a low-risk level to keep the volume of opened orders reasonable.

This system is ideal for building long-term cash flow, but it is not recommended for trades aimed at manipulating lot size for rebates or introducing brokers (IB), as trading volume may fall short of targets. As a starting point, we recommend opening the first lot at 0.01 for a capital of $1,500.

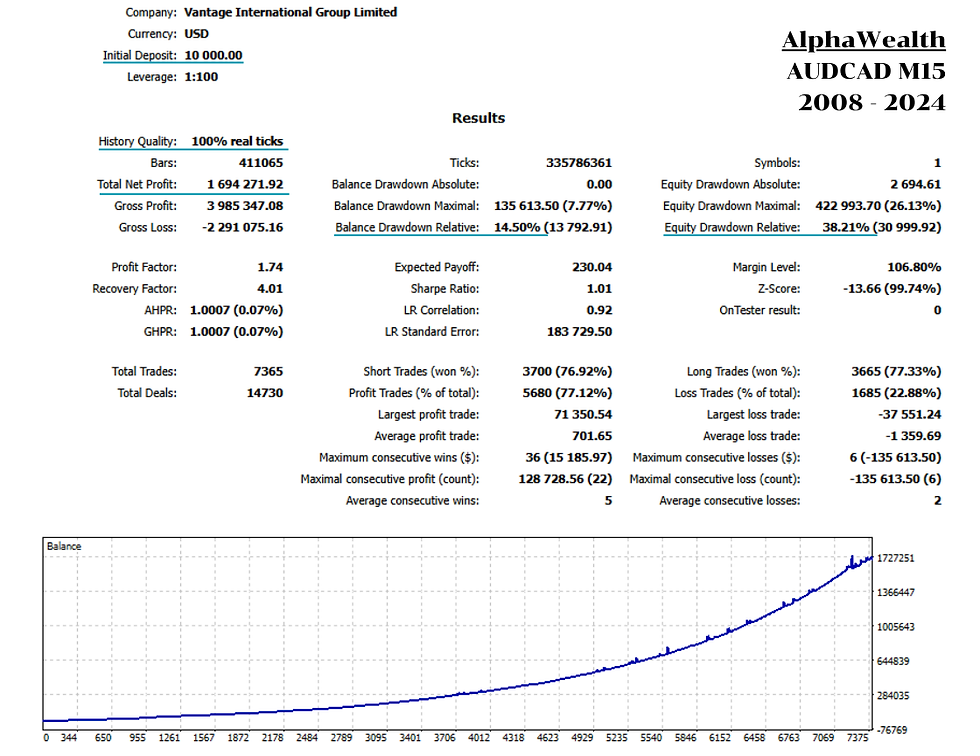

The backtest results for AlphaWealth on the AUD/CAD pair using the Vantage MT5 broker on a Raw account from 2008 to 2024 show a total profit of $1,694,271 from an initial investment of $10,000.

*Past performance does not guarantee future results.

This EA has been trading on a live account for over a year, with results available on Myfxbook demonstrating satisfactory returns and exceptionally low drawdowns.

AlphaWealth Trading Strategy Overview

AlphaWealth initiates a buy when the candlestick's closing price in the M15 timeframe falls below the lower Bollinger Band and sells when it closes above the upper Bollinger Band. To filter signals, a stochastic oscillator is used to trade only in overbought or oversold conditions.

The take profit (TP) for the first order is set at 10 pips (configurable in EA settings). If the price hits the TP, the order is cleared, and the system will search for new signals. However, if the price does not reverse as anticipated, the EA will open a second order in the same direction with the same volume, issuing a new order when the price moves 40 pips up or down from the previous order.

Starting from the third to fifth order, the system doubles the lot size based on the Martingale money management principle. For the sixth to eighth orders, the volume is reduced to 1.5 times the previous order’s volume to minimize overtrading, with a cap ensuring no more than eight orders are open at a time.

The AlphaWealth EA sets a stop loss at -60%. Based on 17 years of historical price testing (2008-2024), if users select the auto lot size method and keep the settings below 70 or opt for high risk levels, this system has proven to be resilient in the market, generating consistent returns over the entire 17-year span.

*Past performance does not guarantee future results.

AlphaWealth and AlphaEdge share a similar trading strategy and functionality. If investors are interested, they can read more about the overtrading approach in the AlphaEdge trading strategy.

Both AlphaWealth and AlphaEdge are well-suited for running EA farms, providing a good way to diversify risk. Often, traders select EAs that trade the same currency pair, such as all EAs trading the EUR/USD. If the EUR/USD chart does not perform as expected at any given time, all trading systems could face simultaneous losses. Therefore, diversifying strategies and assets traded can be a better money management approach.

By using both AlphaWealth and AlphaEdge within an EA farming setup, investors can achieve a balanced exposure across different currency pairs. This diversification not only mitigates the risk of simultaneous drawdowns but also allows traders to capitalize on various market conditions. Overall, it’s a prudent strategy to manage capital effectively while maximizing potential returns in the long run.

EA Configuration Guide

For Standard Account (Contract Size = 100,000)

If investors choose the Lot Sizing Method setting in the EA as AutoLot, the system will calculate the lot size based on a percentage of the account balance. For example, if you set AutoLot_BasePercentOfBalance = 50 (the default value in the EA), the EA will place the first order with a lot size of 0.01 for a capital of approximately 1,500-1,700 USD. It will then automatically adjust the lot size of the subsequent orders according to changes in the balance.

If investors choose the Lot Sizing Method as RiskLevel, the system will also calculate the lot size of the initial order based on the percentage of the account balance. However, this method calculates the lot size automatically based on the risk level the investor selects: Low Risk, Moderate Risk, Medium High Risk, or High Risk.

If investors select the Lot Sizing Method as Fixlot, the system will place the first order according to the lot size that the user specifies in the EA settings. For example, if an investor chooses Fixlot and sets the value in the fixlot field to 0.01, the system will always place the first order with a lot size of 0.01, regardless of changes in the account balance.

For Micro or Cent Accounts

It is not recommended to use the RiskLevel Lot Sizing Method, as the EA's RiskLevel calculations are designed specifically for standard accounts. Investors can choose either the AutoLot or Fixlot settings according to their preferences.

For Micro and Cent accounts, we recommend using the AutoLot setting. Users can input a percentage value in the AutoLot field as desired and can backtest to find the suitable values. If unsure, investors can seek guidance by informing our team via email about their account type and broker for EA trading.

Initial Recommendations:

- For Micro accounts, it is recommended to set AutoLot = 5.

- For Cent accounts, it is recommended to set AutoLot = 0.5.

AlphaWealth EA Usage Recommendations:

- Account Type: It is advisable to use accounts with low spreads, such as ECN / Raw / Pro accounts.

- Leverage: Use from 1:100 and above.

- Initial Capital: 1,500 USD for standard accounts or 1,500 US Cent for cent accounts (1,500 US Cent = 15 USD).

Comments